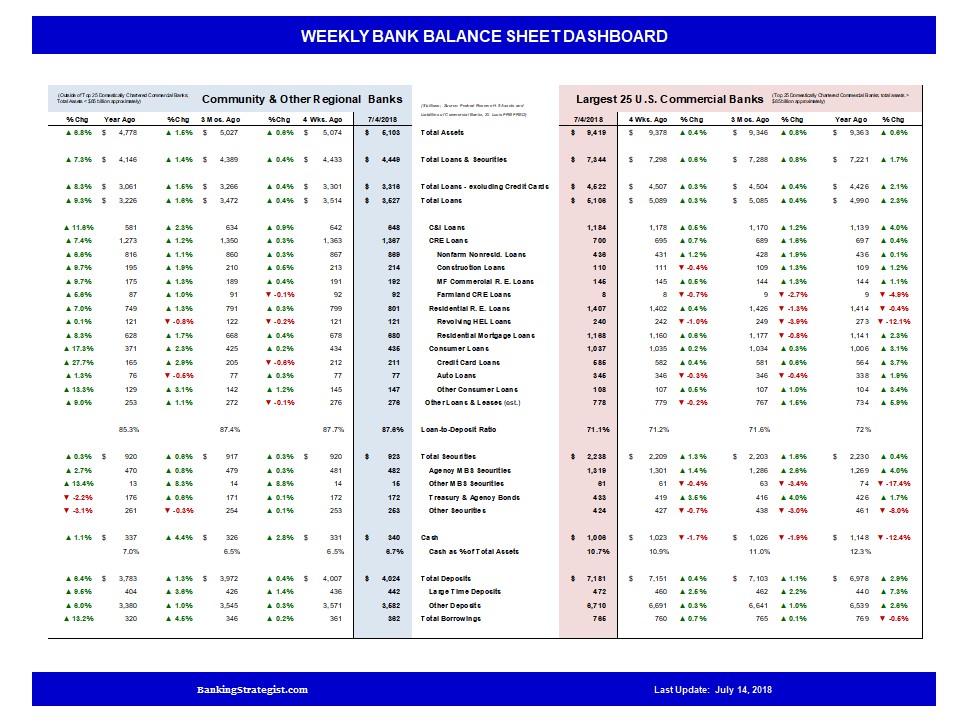

As we move through Q2 2018, the divergent trend between the loan growth of the largest 25 banks and that of community & regional banks continues. Data is from the Federal Reserve Bank's weekly H.8 report - Assets and Liabilities of Commercial Banks.

Community & Regional banks continue to show strong loan growth, while the larger banks have slowed. Even eliminating the impact of Wells Fargo with their regulatory-mandated balance sheet constraints, the growth rate for the other large banks remains less than one-half that of Community & Regional banks.

The variation suggests reasonably strong economies continue at the local and regional levels.

This chart below shows the diverging trends in year-over-year loan growth rates for the largest 25 banks and for Community & Regional banks. While the trends paralleled each other through summer of 2016, the growth for Community & Regional banks continued much stronger since.

From an overall balance sheet management perspective, the strong loan growth for Community & Regional banks has resulted in some balance sheet expansion. Total assets have risen at a slightly slower pace (6.8% YoY) with loan growth funded by both solid growth in deposits (+6.4% YoY), increased FHLBank and other borrowings (+13.2% YoY) and constraint on investment securities portfolio expansion (+0.3% YoY). For Large Banks, the balance sheet has been managed resulting in negligible growth (+0.8% YoY). The modest loan growth (+2.3% YoY) was supported by modest deposit growth (+2.8% YoY) and nearly flat investment securities portfolio (+0.4% YoY).

For more trends and other information on Community Banks and the banking industry, go to Banking Strategist.