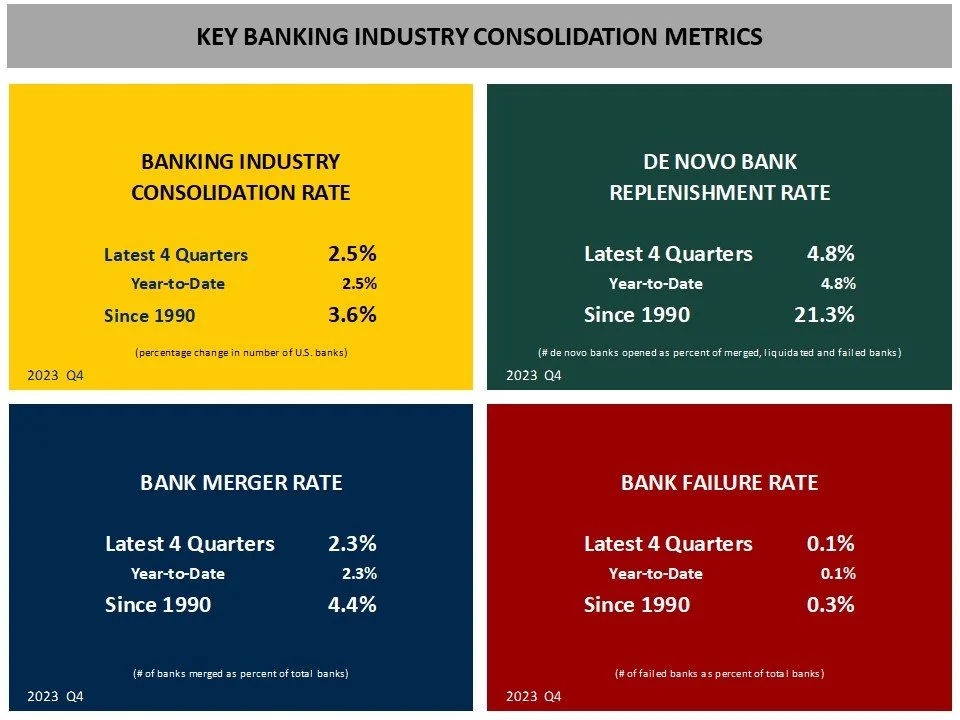

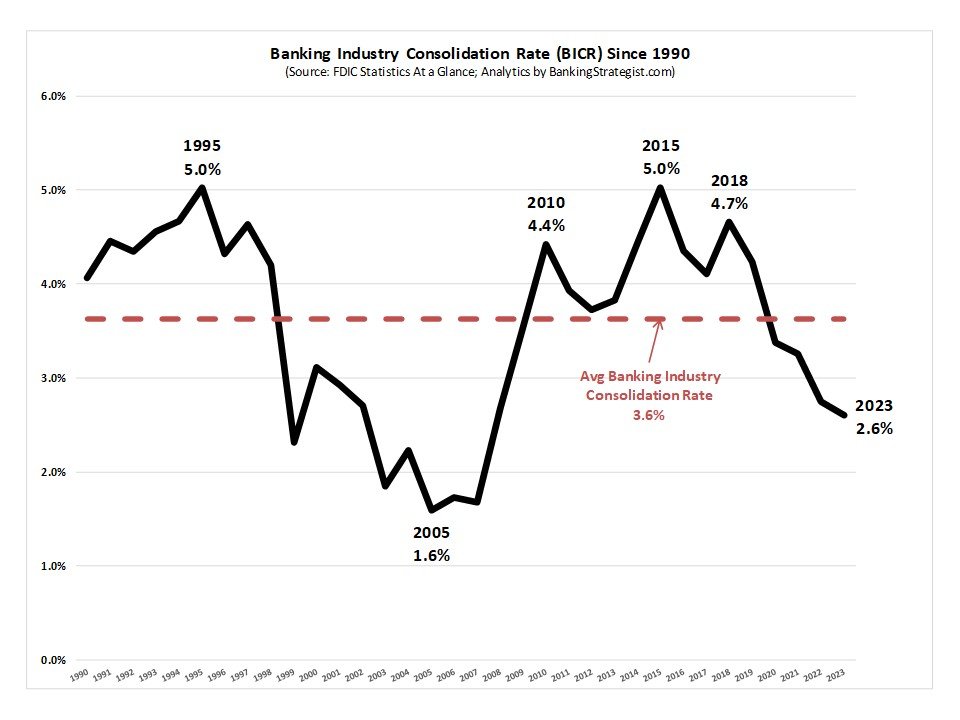

THE BANKING INDUSTRY CONSOLIDATION CONTINUES BELOW HISTORICAL AVERAGES.

Banking Industry Consolidation Rate = 2.3% for L4Q. The pace of industry consolidation was well below the historical average since 1990 of 3.6%. The industry is in its fourth year of below average consolidation.

Bank Merger Rate = 2.0% for L4Q. The pace of bank merger activity was well below the historical average since 1990 of 4.3%. The Bank Merger Rate during the Q2 was the lowest in last three decades.

Bank Failure Rate = 0.1% for L4Q with four (4) bank failures. The historical average since 1990 is 0.3%.

De Novo Bank Replenishment Rate = 5.4% for L4Q - even with such low merger activity. The replenishment rate was well below the historical average since 1990 of 21.3%.

NUMBER OF U.S. BANKS:

Overall, the number of U.S. banks fell to 4,539 at the end of Q22024 - down 106 from one year ago.

The largest declines continued to occur in Community Banks with less than $500 million in total assets.

And the largest declines of headquartered banks continues to occur in rural markets with populations of less than 50 thousand.

BANKING INDUSTRY CONSOLIDATION RATE:

Banking industry consolidation net activity continued its slow pace during 2024 Q2 L4Q. The Banking Industry Consolidation Rate was only 2.3%. The historical average was 3.6% since 1990.

Community banks consolidated at a rate of 2.3% L4Q with only two states showed a consolidation rate of 4% or higher: Florida and Minnesota.

BANK MERGER RATE:

Bank merger activity slowed significantly for the L4Q through Q2 2024. The Bank Merger Rate was 2.0% - lowest merger rate in three decades. The historical average was 4.3% since 1990.

DE NOVO BANK REPLENISHMENT RATE:

De novo banking activity remains historically low with 4 new banks opened during the L4Q through Q2 2024. The De Novo Bank Replenishment Rate was 5.4%, or approximately 5 new banks opened to replace every 100 banks lost to merger, failure or liquidation. This rate remains well below the historical average or 21.3%, or 21 new banks opened to replace every 100 banks lost to merger, failure or liquidation.

BANK FAILURE RATE:

There were four (4) bank failures for the L4Q ending Q2 2024. The Bank Failure Rate was 0.1%.

A small community bank - $140 million in Total assets - failed as a result of a $47 million crypto scam.

Financially, the industry is sound. Earnings were solid. Credit quality continues to look good. And capital levels remain strong.

2024 OUTLOOK: SLOWER CONSOLIDATION

The pace of banking industry consolidation is expected to continue below historic averages.

This pace will result from a below average rate for bank mergers. There is no reason to believe that any unusual resurgence will occur.

The bank failure rate should continue to remain near zero during 2024.

And de novo bank activity will continue at less than 10 per year with the de novo bank replenishment rate in the 5% range or less.