It has been suggested that there are "Too Many Banks". It is not a new statement as it has been raised for the last several decades. Today, there are more than 5,700 banks serving communities across the U.S.

The U.S. banking system is dynamic, continuing to evolve and quite competitive. Consolidation has played a significant role. The number of banks has decreased through mergers and acquisitions and bank failures and offset by de novo bank start ups. While the number of banks has declined by 63% since 1995, total bank assets have increased 2.7 times.

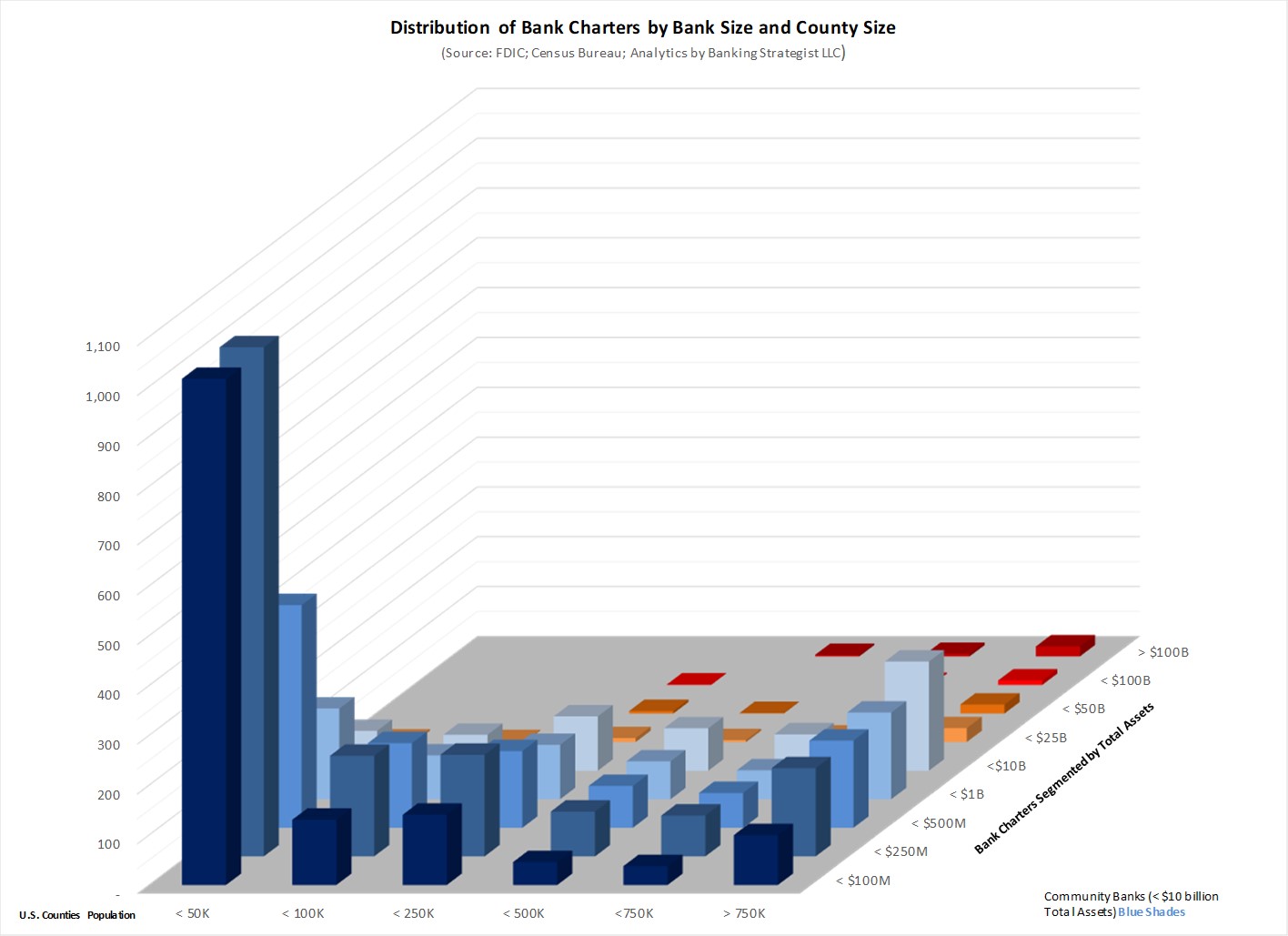

These remaining banks are located in communities of all sizes. Approximately 48 percent of banks (+2,700) are headquartered or chartered in counties with populations under 50,000. 68 percent of U.S. counties are of this size - +2,100 counties. The banking industry serves an important and vital role in these smaller, rural communities.

And the banks that serve these communities tend to be the U.S.'s Community Banks. The Community Banks - generally well under $10 billion in total assets - are headquartered in markets of all sizes, but are primarily located in counties with populations of less than 100,000. Often Community Banks are the only banking presence in these communities. Community Banks are key to support the commerce, community and economic development in the smaller markets across the U.S.

Community Banks are located across most of the states in the U.S. with a concentration in the smaller communities within each state. While banking industry consolidation has tended to focus on the metropolitan markets of the U.S., these Community Banks - in all their numbers - have remained a steadfast force within the banking industry in these smaller markets. This is not to suggest that Community Banks do not play an important competitive role in metropolitan markets - which they certainly do.

So when you hear the statement that there are "Too Many Banks", you now have some additional facts at hand for your own assessment. The number of banks will, most likely, continue to decline, but this is different from there are "Too Many Banks". From my perspective, a blanket statement cannot be made as you need to look at each and every market served. Perhaps there are not "Too Many Banks"!